Portfolio and Risk Management

About this Course

In this course, you will gain an understanding of the theory underlying optimal portfolio construction, the different ways portfolios are actually built in practice and how to measure and manage the risk of such portfolios. You will start by studying how imperfect correlation between assets leads to diversified and optimal portfolios as well as the consequences in terms of asset pricing. Then, you will learn how to shape an investor\'s profile and build an adequate portfolio by combining strategic and tactical asset allocations. Finally, you will have a more in-depth look at risk: its different facets and the appropriate tools and techniques to measure it, manage it and hedge it. Key speakers from UBS, our corporate partner, will regularly add a practical perspective on these different topics as you progress through the course.Created by: University of Geneva

Related Online Courses

This specialized program is aimed at computer people who want to enter the field of information systems and learn their different types of requirements, architectures, performance, techniques and... more

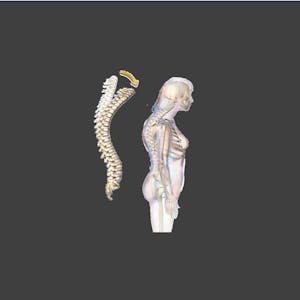

The objective of this project is to predict whether a patient has kyphosis or not, based on given features and diagnostic measurements such as age and number of vertebrae. Kyphosis is an abnormally... more

The courseware is designed to equip participants with a profound understanding of Payroll and HR Management. Tally is a revolutionary product which has been created with the objectives of Simplify... more

The web today is almost unrecognizable from the early days of white pages with lists of blue links. Now, sites are designed with complex layouts, unique fonts, and customized color schemes. This... more

Based on four of the most popular courses taught at the Wharton School, Achieving Personal and Professional Success is designed to introduce the tools and techniques for defining and achieving... more