Introduction to Risk Management

About this Course

What is risk? Why do firms manage risk? In this course, you will be introduced to the different types of business and financial risks, their sources, and best practice methods for measuring risk. This course will help you gauge different risk types and set risk limits, describe the key factors that drive each type of risk, and identify the steps needed to choose probability distributions to estimate risk. You will explore the history and development of risk management as a science, and financial and business trends that have shaped the practice of risk management. By the end of the course, you will have the essential knowledge to measure, assess, and manage risk in your organization. To be successful in this course, you should have a basic knowledge of statistics and probability and familiarity with financial instruments (stocks, bonds, foreign exchange, etc). Experience with MS Excel recommended.Created by: New York Institute of Finance

Related Online Courses

In this course we will work with a number of examples of react components to work our way logically through some of the most commonly used parts of typescript in React. Along the way, feel free to... more

This 4-course Specialization from the New York Institute of Finance (NYIF) is intended for STEM undergraduates, finance practitioners, bank and investment managers, business managers, regulators,... more

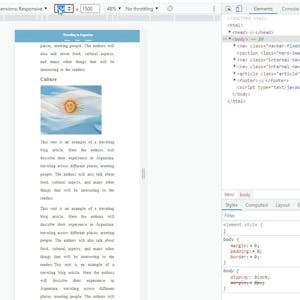

This specialization covers the foundations of visualization in the context of the data science workflow. Through the application of interactive visual analytics, students will learn how to extract... more

This course is primarily aimed at first- and second-year undergraduates interested in engineering or science, along with high school students and prCompute Resources in Azure Course is the third... more

In this project you will learn how to add images to a web page and style them, create links out of images, set up image backgrounds to page sections, and make images responsive to the screen size... more